how to report coinbase on taxes

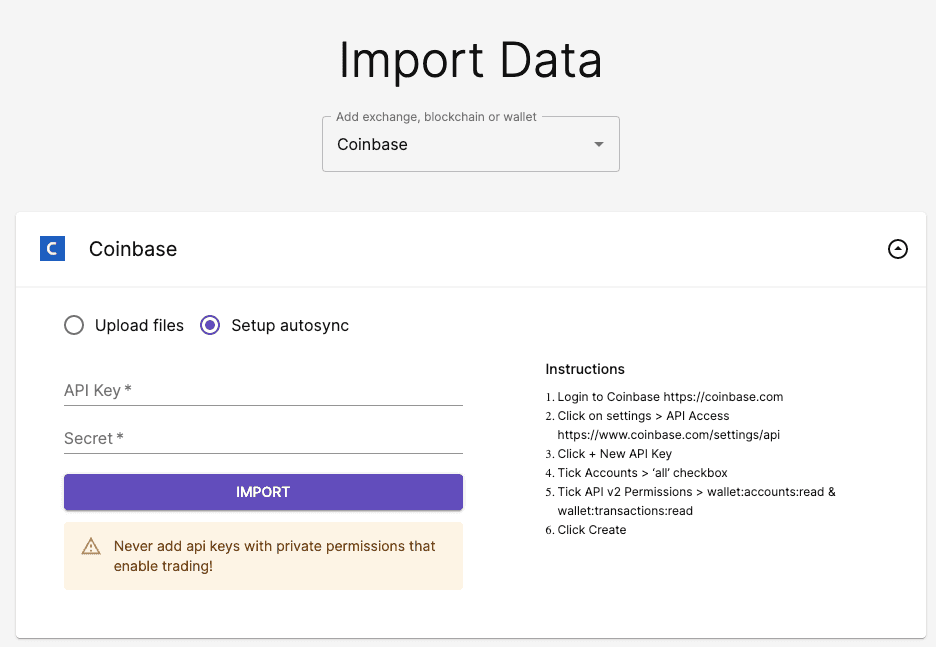

The API will fetch your Coinbase transaction data automatically making far less work for you. You can use this as a tool to actually report taxes OR just simply see how.

The Complete Coinbase Tax Reporting Guide Koinly

For example Coinbase does not provide information to the IRS regarding.

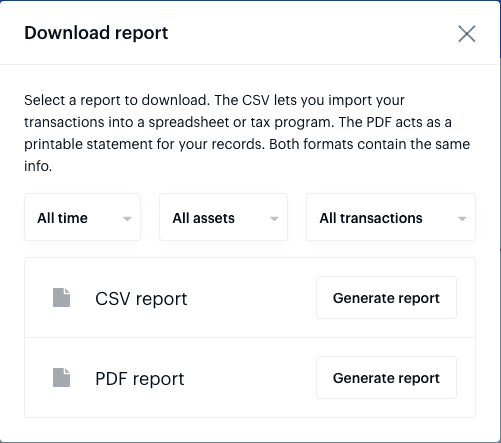

. Click Generate Report for CSV. Web Understanding Coinbase taxes. Web However Coinbase does not currently report all information relating to your crypto activities.

Coinbase Taxes will help you. Web Click the Generate report button. Web Coinbase Pro Tax Reporting.

Web No Coinbase wallet doesnt provide a tax report. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. Veeam check database size.

Web Yes youll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not Coinbase does report your crypto activity to the. Web However if youre using Coinbase Wallet in conjunction with other Coinbase products like Coinbase Exchange or Coinbase Pro both these platforms may issue 1099. Leave the default settings All time All assets All transactions or specify the report you want.

Web If you use Coinbase you can sign in and download your gainloss report using Coinbase Taxes for your records or upload it right into TurboTax whenever youre ready to file. Multi time frame indicator tradingview. Web If you made 600 in crypto Coinbase is required to use Form 1099-MISC to report your transactions to the IRS as miscellaneous income Even if you make less than.

Coinbase one of the largest and most popular cryptocurrency exchanges is. You can generate your gains losses and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger. Web Coinbase Tax Resource Center.

As a result they must download their transaction histories for the local tax obligations. Web If you earn 600 or more in a year paid by an exchange including Coinbase the exchange is required to report these payments to the IRS as other income via IRS Form 1099-MISC. Select the relevant cryptocurrency.

You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with. Coinbase Pro Coinbase Tax Resource Center. Web Coinbase Tax Reporting.

Web Coinbase 1099. Adobe media encoder how to. Web families around the world book.

Coinbase Wallet doesnt have KYC and would have no way to issue a report with your details. Web Note that these tax forms do not report capital gains or losses. Its the form used for crypto exchanges because it doesnt simply detail profits it lists.

Form 1099 reports your third-party transactions to the IRS. For the 2020 US tax season Coinbase will issue the IRS Form 1099-MISC for rewards andor fees. Web The easiest way to do this is using the Coinbase tax report API.

Web To add your Coinbase Wallet account to Coinpanda follow these steps. City brew caffeine content. Web Use the Coinbase tax report API with crypto tax software.

Web Coinbase makes it easier to report cryptocurrency taxes. You can generate an API in Coinbase Pro and input this into your chosen crypto tax app to automatically. You can however use your.

Paste your xPub address or public address.

.jpeg)

How To Do Your Coinbase Taxes Coinledger

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/GPHSXPMRWBDDNGA7AWVSFYENWY.jpg)

Coinbase Users Can Now Receive Tax Refunds In Crypto Through Turbotax

![]()

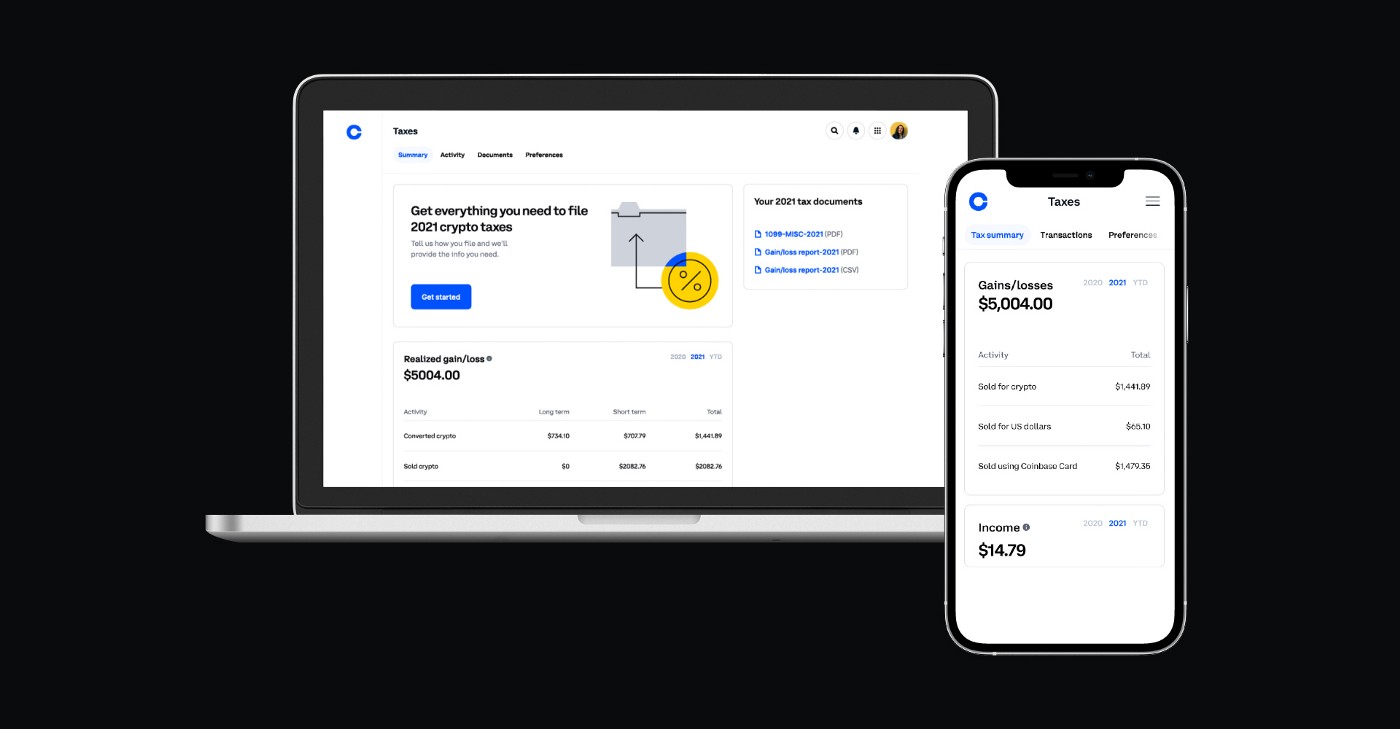

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

Crypto Tax How To Report Your Virtual Currency Bitcoin Ethereum Coinbase Etc The Official Blog Of Taxslayer

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Crypto Taxes How To Calculate What You Owe To The Irs Money

Coinbase Is Now Your Personalized Guide To Crypto Taxes Coinbase

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

Coinbase Is Now Your Personalized Guide To Crypto Taxes Coinbase

Does Coinbase Report To Irs All You Need To Know

Coinbase Tax Form Changing What It Means For You Founder S Cpa

Tweets Dont Tax Advice On Twitter Fintaxdude Coinbase This Is Funny We Are Not Required To Issue A Form 1099 B Or Issue Reporting To The Irs If You Sell Trade

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology